Trusted

by 50+ clients

Most Accurate Physical Prices database

Independent and proprietary data

WHAT WE OFFER

Launched in 2023, our platform has used a stringent methodology to gather accurate data from historically confidential physical corn & soybeans markets.

Our focus lies entirely on Financial Institutions, with a special emphasis on Hedge Funds. Unlock the potential of quantitative studies comparing Brazilian grains to American SB contracts, while examining into the complex landscape of Chinese demand and freight parity. Elevate your strategic decisions with our tailored offerings designed to navigate the complexities of the commodities market.

"Having access to reliable physical commodities values daily has never been that easy & fast”.

I realized recently that my trading has been based for years on wrong commodities prices. The live prices from Deepcore during the trial allowed me to compare daily with numbers from generic vendors.... almost had a heart attack."

"Thanks to Deepcore datasets, I’m more confident in my commodities analysis & trading and my team and I save plenty of time."

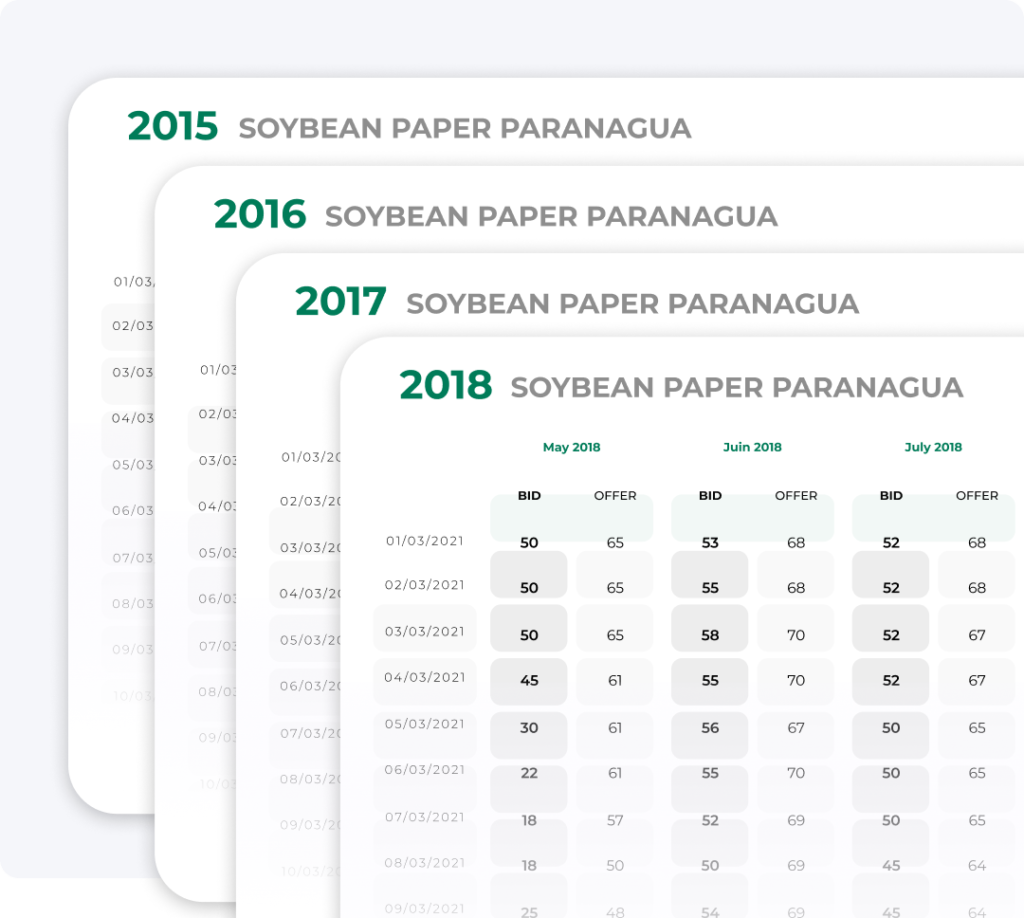

How did Soybeans trade in MAY 2018, and what was the ZS futures like at that time? Compare the recent peak of FOB Soybeans Paper Paranagua to ZS spot Futures over the past year. Whether you’re a quantitative or discretionary Hedge Fund, Trader or analyst, cash prices data is essential.

Give your team clear visibility of global commodity prices:

FOB Corn Santos, FOB Soybeans Paper Paranagua, FOB Soybeans Meal Santos and Soybeans Santos.